Bank Reconciliation with Dynamics GP using Nolan ABR for Canada

Advanced Bank Reconciliation for Microsoft Dynamics GP ERP in Canada and USA

Nolan Business Solutions is an approved GP Support North ISV partner. Approved ISV Partners. Their award-winning add-on software is used to support advanced bank reconciliation (ABR) for Microsoft Dynamics GP 2020 and earlier (Great Plains). Our North American clients in Canada and the USA use Nolan bank rec (ABR) to save their finance team time and effort in performing their daily, weekly or monthly bank-rec in Microsoft Dynamics GP (Great Plains). As a Nolan Advisor, you can contact our team for software renewals, quotes, pricing and discussions around GP Bank Rec product licensing, integration and configuration.

New - Watch the video on Core vs More for Bank Reconciliation comparing GP Core functions with Nolan Bank Rec.

Nolan ABR can give you a faster bank-rec process: from hours to minutes

The goal of Nolan Advanced Bank Rec is to: auto-match as many GP transactions as possible

Unlike GP’s reconciliation tool, ABR doesn’t care about the Checkbook ID’s.

It links the Bank Account numbers to one or more GL Accounts (cash accounts).

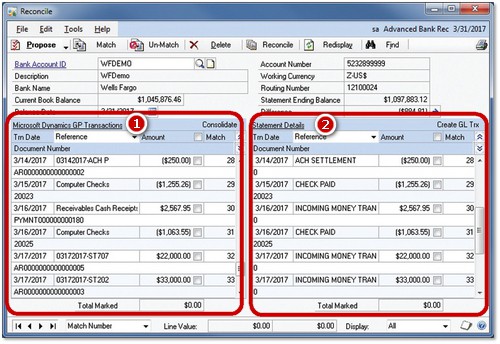

Compare, auto-match and reconcile (1) Dynamics GP transactions with (2) Bank statements from Canadian and USA banks.

- Auto-post Bank Transactions- automatically create/post GL journals from your statement.

- Automatic Extract – automatically extract GL transactions when you open the ABR reconcile window.

- Auto-reconcile imported bank transactions to posted GL transactions (with or without GP Checkbook IDs).

- Reconcile rules are defined against the Company or individual bank.

Auto-group transactions using the Deposit Groups. - Print historical reports.

- Unreconcile: Ability to undo a previously performed reconciliation

- Easily inquire if a cheque has cleared the bank

- Set reconciliation rules using specific tolerance levels / %

- Post to multiple GL's and support inter-company postings

Comparison - Microsoft Dynamics GP Bank Rec vs. Nolan Advanced Bank Rec. (ABR)

Features |

Dynamics

|

Nolan ABR |

|

| GP Bank Reconciliation module dependency | YES | YES | |

| As per GP standard menu options | YES | YES | |

| Can use multiple GL accounts | NO | YES | |

| Simplified interface | YES | YES | |

| Multi-company import processing | NO | YES | |

| CSV file import supported | NO | YES | |

| BAI format import supported | NO | YES | |

| Deposit grouping | NO | YES | |

| Advanced reconciliation rules | NO | YES | |

| Automatically Post bank statement transactions to the GL | NO | YES | |

| Option to un-reconcile if you make a mistake | NO | YES | |

Helpful Video Content

Nolan ABR demo for Microsoft Dynamics GP - Great Plains (35:01min)

Are you a good fit for Nolan Advanced Bank Reconciliation? Here are some examples:

Companies with:

- High transaction volumes (for example, retailers and restaurants)

- Multiple bank accounts

- Multiple GL cash accounts

- Credit card transactions

If you need to:

- Use deposit groups

- Process cash transactions outside of GP and import in as a GL entry to GP

- Pay your vendors by ACH, EFT and wires, plus cheques (GP cannot reconcile ACH)

Automated Clearing House (ACH), Electronic Funds Transfer (EFT), Wire Transfer as each used by Canadian Banks including TD Bank, RBC - Royal Bank Canada, CIBC, Scotiabank - Bank of Nova Scotia, BMO - Bank of Montreal, and most Credit Unions in Canada.

Bank statements can be downloaded as .csv (comma separated values) or using the BAI and BAI2 file formats (Examples AP Cheque = (BAI 475), Deposits = (BAI 301) and Transfer = (BAI 195)